By Vasiliki Carson, CEO, Sapphire Capital Partners LLP

I've spent years analysing what separates successful investments from mediocre ones. Early-stage investors and founders often fixate on product, market fit and valuation. Yet my recent conversation with Guy Avshalom reminded me that genuine leverage lies elsewhere entirely...

I'm grateful to Guy for sharing his time with me. His journey from founding team member of the Redbus Group to orchestrating its £35 million sale to Lionsgate Entertainment in 2005, offers lessons I wish I'd learnt earlier in my career. Following the acquisition, Guy served as an executive director for all Lionsgate group companies in the UK, helping transform Lionsgate UK into one of Europe's most successful entertainment businesses. He now serves as Chairman and Co-Founder of Blackbox Multimedia as well as Adviser on International Corporate Strategy at Gunnercooke.

I asked Guy to reflect candidly on the Redbus exit and what he'd learnt about the transition from entrepreneurial "maverick" to corporate executive. What he shared challenged some of my assumptions about what truly drives value.

Who is a Maverick?

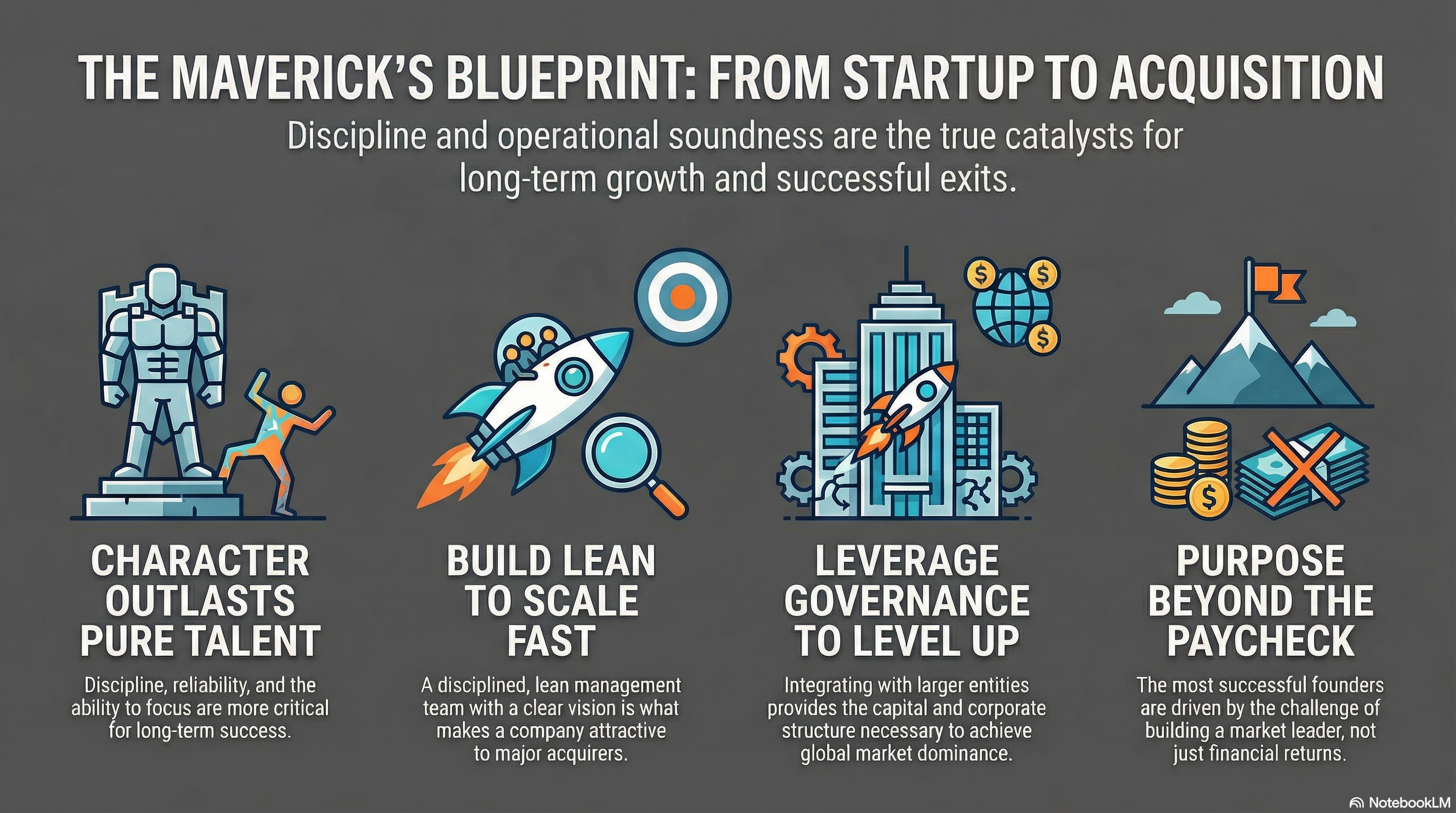

We all romanticise about maverick founders, but Guy made a compelling case that character is a far better predictor of long-term success than raw talent alone.

When I pressed him on how to distinguish between a "visionary maverick" and a "chaotic operator," his answer was refreshingly practical. Look for discipline, he said: the ability to turn up on time, maintain focus and deliver results. As he put it, talent is marvellous for "making a show", but building an enduring business requires the unglamorous discipline of showing up, every day, for years.

“Strong character traits, like discipline and good communication, are more important for building a successful business over the long term than pure talent”

This resonated deeply. I've watched brilliant founders flame out whilst more methodical ones built lasting value. The traits that mattered at Redbus? Reliability, punctuality, clear communication, unwavering focus, genuine team leadership, and the ability to sell the vision convincingly.

My take-home insight: When I'm evaluating founders now, I pay as much attention to their execution habits as to their ideas.

They Bought a Machine, Not a Dream

Guy was refreshingly candid about why Lionsgate acquired Redbus. It wasn't for the creative library. It was for the lean management team and operational discipline. Redbus had proven they could acquire the right films at the right price and deliver a positive bottom line.

This struck me as the essence of what acquirers actually want. They didn't buy a collection of creative mavericks; they bought a functioning machine with clear responsibilities, cohesive vision, lean operations, proven commercial judgement, and measurable profitability.

It's made me reconsider how I assess potential exits. The question isn't just "is this exciting?" but "would an acquirer want to plug this into their platform?"

My take-home insight: I now look beyond pitch decks to the operating rhythm: how quickly do they make decisions? How clear are the feedback loops? Who owns what?

Governance as Growth Enabler

This was perhaps the most counter-intuitive insight for me. Guy described the "massive value" of integrating into Lionsgate's larger entity; not just the capital, but the governance structures themselves.

I'll admit, I used to view corporate governance as bureaucratic overhead. Guy helped me see it differently. Joining Lionsgate unlocked deeper capital resources, embedded industry networks, sophisticated financial reporting, and processes that enabled the business to scale far beyond what it could have achieved independently.

Guy acknowledged the frustration many founders feel with corporate politics and process. But he also made clear: you cannot build an institution without this scaffolding.

My take-home insight: When I'm assessing founders now, I ask myself: are they willing and able to grow into this next level? Or is their comparative advantage in serial creation at smaller scale? Both are valid, but the distinction matters enormously.

When It Stopped Being About the Money

One of the most honest moments in our conversation came when Guy discussed motivation. He told me that for the Redbus team, the deal eventually "stopped being about the money" and became about the challenge of building dominance.

This doesn't mean financial returns were irrelevant... far from it. But Guy explained that high-performing founders blend two things: the legitimate desire to make money and genuine passion for building something excellent or culturally meaningful.

“Some executives have a limited appetite for the necessary corporate governance... preferring to move on to the next venture while others have the capacity to flow with the change, learn, and develop.”

I've seen this pattern repeatedly in my own portfolio. The founders obsessing over valuation and "the next round" often struggle. Those obsessed with building dominant, well-run companies tend to see valuations follow naturally.

My take-home insight: When I meet with founders, I probe for this blend. Pure mercenaries worry me! Pure idealists worry me! I worry a lot, but when I see founders who've integrated both? That's who I want to invest in.

Creative Excellence Needs Commercial Discipline

Guy was adamant about this: a film that's creatively brilliant for the wrong price is a poor business decision.

His framework is elegantly simple: treat projects as portfolio assets, price risk properly, measure performance rigorously, and never let "we love it" override "does this make sense at this cost?"

I've started applying this lens beyond creative industries. It's remarkable how often excitement about a product or technology clouds commercial judgement.

The Soft Power Premium

This was the insight that's resonated with me most. Guy explained that creative industries punch far above their financial weight in terms of cultural and political influence. Films and television project national narratives worldwide, shaping how we see ourselves and others.

Even commercially driven films can capture cultural moments (he cited "Bend It Like Beckham" and its impact on women's football) and influence conversations far beyond their profit and loss account.

I hadn't fully appreciated this dual nature of returns: financial and cultural. Creative IP businesses carry strategic and reputational leverage disproportionate to their current revenue.

My take-home insight: When I'm evaluating creative sector investments, I now consider both dimensions of value.

What I'm Taking Forward

From my conversation with Guy, here's what's changed in how I think about investing:

-

I now value character and discipline as much as talent.

-

I study the operating machine, not just the pitch.

-

I treat governance as a scaling asset, not an irritant. I look for founders building major players, not just seeking the next exit.

-

And in creative sectors, I factor in soft power when judging long-term value.

If you're a founder reading this, know that your daily habits, i.e., punctuality, preparation, clarity, are part of how we assess you. Design your company as a system an acquirer would want to integrate. Decide early whether you're willing to grow into governance and scale. Let money be the result of excellence, not the only goal.

Guy's message is simple but demanding: build something disciplined enough to make money, and meaningful enough to matter.

That's a standard worth aspiring to.

Disclaimer:

This article is provided for information and educational purposes only and does not constitute, and should not be relied upon as, investment advice, legal advice, regulatory advice, or a financial promotion for the purposes of section 21 of the Financial Services and Markets Act 2000 (FSMA).

The views expressed are those of the author at the time of writing and are based on personal experience and opinion. They do not represent a recommendation, offer, solicitation, or invitation to buy or sell any investment, financial instrument, or fund, nor do they constitute advice on the merits of any investment decision.

No reliance should be placed on the content of this article when making investment or business decisions. Readers should seek independent professional advice before taking any action.

Past performance, experiences, or examples referred to are not a reliable indicator of future results.

Where the author or their firm is authorised and regulated by the Financial Conduct Authority, this article is not issued or approved for the purposes of financial promotion and is not directed at retail clients.

Next Steps:

If you would like to contact us to inquire more about Sapphire Capital Partners LLP, fill out this form, and we will be in touch right away.