In today’s rapidly evolving financial landscape, diversity is not just a buzzword - it is a critical driver of innovation and sustainable growth. The Investing in Women Code led by the Department for Business and Trade, is a significant commitment to support the advancement of women entrepreneurs in the UK by improving their access to the tools, resources and finance they need to achieve their goals.

In 2019, Alison Rose, the CEO of NatWest Group, published the Rose Review which unveiled several shocking insights regarding the levels of female entrepreneurship in the UK. Notable among these were:

- Only one in three entrepreneurs in the UK is a woman

- Only 5.6% of women in the UK run their own businesses

- If women in the UK were to establish and grow businesses at the same rate as men, they could potentially contribute an additional £250 billion to the UK economy.

In response to the findings, the Investing in Women Code was established - an initiative

aimed at financial service providers, including banks, investment firms and venture capital

firms. Signatories are committed to removing barriers hindering women entrepreneurs' access to capital.

The Investing in Women Code recently published its 2023 Annual Report, and it presents several significant positive findings:

- There are now 204 signatories to the Code, up 43% from March 2022:

- Angel groups with a higher proportion of female investors achieved a stronger deal flow of women founders and made a higher proportion of their total investment into all-female teams.

- For the third year in a row, a higher percentage of VC deals made by the Code signatories feature at least one female founder (35%) as compared to the wider market (27%).

- VC firms that have signed up to the Code represent a larger share of the market than ever before. The proportion of UK VC deals involving a signatory has risen from 24% in 2020 to 39% in 2022.

- £667 million equity investment was requested in total, compared to £543 million in 2021 – a considerable and notable increase from last year. This reflects more ambition for investment in start-up and early-stage businesses.

Despite these encouraging findings, the results also reveal a sobering reality - women-led businesses continue to face alarming disparities in the funding they request and ultimately receive:

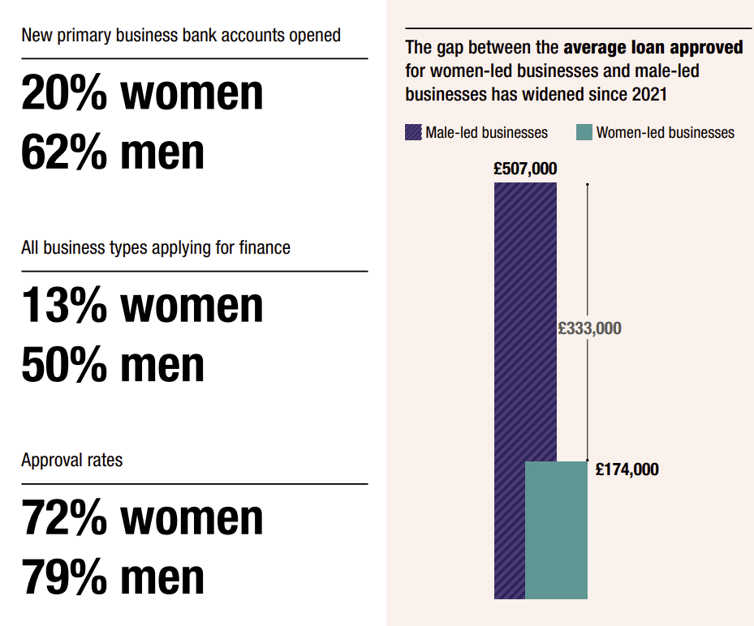

- The report found that unfortunately, women-led businesses continued to receive smaller amounts of loan finance. The gap widened in 2022, with the average amount for women-led businesses being £174,000, a mere 34% of the average amount of £507,000 for their male-led counterparts.

- The data revealed an overall decrease in the level of Angel Investment given to female founders, including mixed-gender teams, compared to the previous year.

- Female investors remain under-represented on investment committees. Signatories report an average of 32% female representation in their investment teams and 24% on their investment committees.

- The Gender Index reported that in 2022, 16.8% of all active UK companies were women-led. Among larger company size bands, levels of female leadership were significantly lower, averaging around 11% in England - a broadly similar level in other parts of the UK.

Source: British Business Bank

The Investing in Women Code represents an essential stride towards gender equality and economic empowerment for women entrepreneurs. While it has made significant headway, the challenges that persist underscore the need for ongoing commitment and collective action to break down barriers and create an inclusive, thriving environment for women in entrepreneurship. Together, we can ensure that women have equal access to the tools and resources they need to achieve their goals and contribute their full potential to the UK's economy.

How to get involved

If you are interested in becoming a signatory, organisations are eligible to do so if they provide debt or equity finance to businesses. Code signatories are also required to make a series of commitments including:

- Nominating a key individual to be responsible for supporting equality in interactions with female entrepreneurs.

- Adopting internal practices to improve female entrepreneurs’ access to tools, resources and finance.

- Providing data about the organisation’s activities, together with case studies of its work with female entrepreneurs.

For those who believe that their organisation aligns with these commitments, reaching out to investinginwomencode@beis.gov.uk is the next step to express interest and take part in this vital initiative.

Sapphire Capital Partners LLP is authorised and regulated by the Financial Conduct Authority (FRN: 565716). The content is for information purposes only and does not constitute investment advice or a recommendation to invest. SEIS and EIS tax reliefs depend on individual circumstances and may change. The value of investments may go down as well as up, and investors may not get back the full amount invested. Past performance is not a reliable indicator of future performance. Investment outcomes can differ substantially, potentially resulting in the loss of all your capital invested. Shares in early-stage companies are illiquid: you may be unable to sell your holding for several years, if at all. Investors should not rely on this article as a basis for investment decisions and must consider the illiquid and high-risk nature of early-stage investing. No warranty as to future outcome is implied nor should one be inferred. Tax treatment depends on individual circumstances and may be subject to change. Investments of this type are generally not covered by the Financial Services Compensation Scheme or the Financial Ombudsman Service if the underlying companies fail.

.jpg)