At Sapphire we are often asked to advise on the structure of a new SEIS Fund or EIS Fund ("Fund"). A SEIS or EIS Fund is normally used when a group of investors want to invest in a selection of companies (as opposed to only one company) that qualify for SEIS/EIS reliefs. It is a method of investing that is becoming increasingly popular due to the advantageous SEIS/EIS tax reliefs and the diversification of the investments.

At Sapphire we are often asked to advise on the structure of a new SEIS Fund or EIS Fund ("Fund"). A SEIS or EIS Fund is normally used when a group of investors want to invest in a selection of companies (as opposed to only one company) that qualify for SEIS/EIS reliefs. It is a method of investing that is becoming increasingly popular due to the advantageous SEIS/EIS tax reliefs and the diversification of the investments.

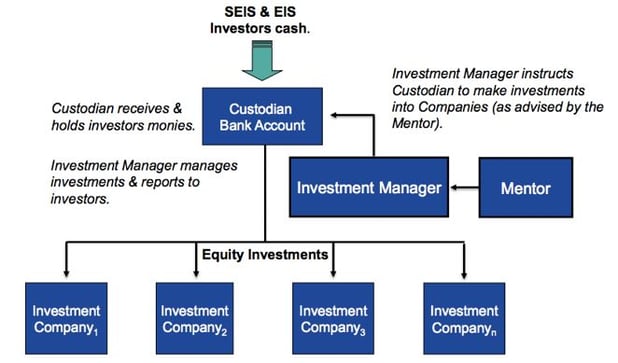

Below is a brief explanation of a typical SEIS or EIS Funds structure.

The Basic SEIS/EIS Fund Structure:

A SEIS or EIS Fund is a discretionary investment management service managed by a Financial Conduct Authority ("FCA") approved Investment Manager (such as Sapphire Capital Partners LLP). The Fund is not a legal entity but a group of individual bare trusts to enable subscription monies to be held on behalf of investors under a nominee arrangement. Each investor will be the sole beneficiary of each bare trust to be know collectively as the Fund (or Portfolio). The Custodian (via a Nominee) is the registered legal holder of investments on behalf of each investor.

The below diagram highlights this type of Fund's typical structure:

In the above diagram it is important to note that no legal entity exists. This ensures that the Fund investors will be able to claim SEIS/EIS reliefs. In order to qualify for SEIS/EIS reliefs the investors must invest directly (i.e. own shares in) in the underlying companies. If a legal entity did exist the investors would not have direct ownership of the underlying companies.

The Role of the Investment Manager:

By agreeing to invest in the Fund, the investors will appoint an Investment Manager to invest their monies on a discretionary basis into companies selected by the Investment Manager. The FCA have indicated that, in their view, SEIS and EIS funds fall within the definition of "Alternative Investment Funds" for the purposes of the Alternative Investment Fund Managers Directive ("AIFMD"). The Investment Manager is therefore required to hold the necessary permissions to act as a manager under the terms of the AIFMD.

The Role of the Custodian:

The Custodian provides safe custody services in relation to the investment and the investors cash pursuant to a custody agreement. The Custodian deposits and holds the investors cash in one or more bank accounts, in which investors funds may be aggregated with any bank institution that is regulated by the FCA and will be deposited in a segregated client money account in accordance with the rules and guidance in CASS 7 of the FCA Handbook. It is noted that the Custodian neither provides investment advice nor gives investment advice.

The Role of the Mentor/Investment Adviser:

Often the Fund will engage a Mentor or Investment Adviser in order to provide additional services such as legal, taxation, marketing, accounting, public relations, information technology and other areas in which startup companies may need expert advice. An Investment Adviser authorised by the FCA can also provide important investment advice to the Investment Manager regarding the suitability of the companies which are potential investments.

The Life of the Fund:

In order to retain the SEIS/EIS reliefs, investors must hold their shares for three years in the companies which the Fund has invested in. Normally the Investment Manager will require that the investors will hold their shares in the Fund for longer periods e.g. up to ten years. It is noted that the Investment Manager typically retains the right to sell the investors shares at any time, even within the SEIS / EIS three year period. Therefore the purchase and sale of shares in the companies the Fund invests in is at the discretion of the Investment Manager.

We hope you find the above useful. As always the devil is in the detail so please contact us if you need any clarification. All our contact details are on our team web page.

Sapphire Capital Partners LLP is authorised and regulated by the Financial Conduct Authority to conduct investment business.