Steinway & Sons have been making the world's finest pianos for over 160 years, and their instruments have become global icons of high culture. The company was acquired in 2013 by a notable private equity firm for $438 million, and by 2018 there was a take-over price offer on the table for $1 billion! This valuation is high especially for a manufacturer with quirks, like requiring the instruments to return to the workshop in Queens, New York to get repaired. What did Herr Steinweg estimate his business would be worth when he first started trading? Did he expect his company to become a global symbol of craftsmanship? I believe so.

Differing valuation viewpoints

Entrepreneurs struggle to objectively value their companies due to all the blood, sweat and tears shed to get their idea through to fruition.

Investors, on the other hand, see the company differently than entrepreneurs. Their opinion depends also on whether they are related to the entrepreneur, or if they are a business angel.

Fund managers value differently due

to their investment expertise, potential lack of understanding of technical matters specific to that business, or inability to "connect" with the entrepreneur's vision. And then, there are those unforeseen market conditions. In recent discussions with EIS fund managers, I heard complaints that valuations on investment propositions appear to be highly overvalued at present.

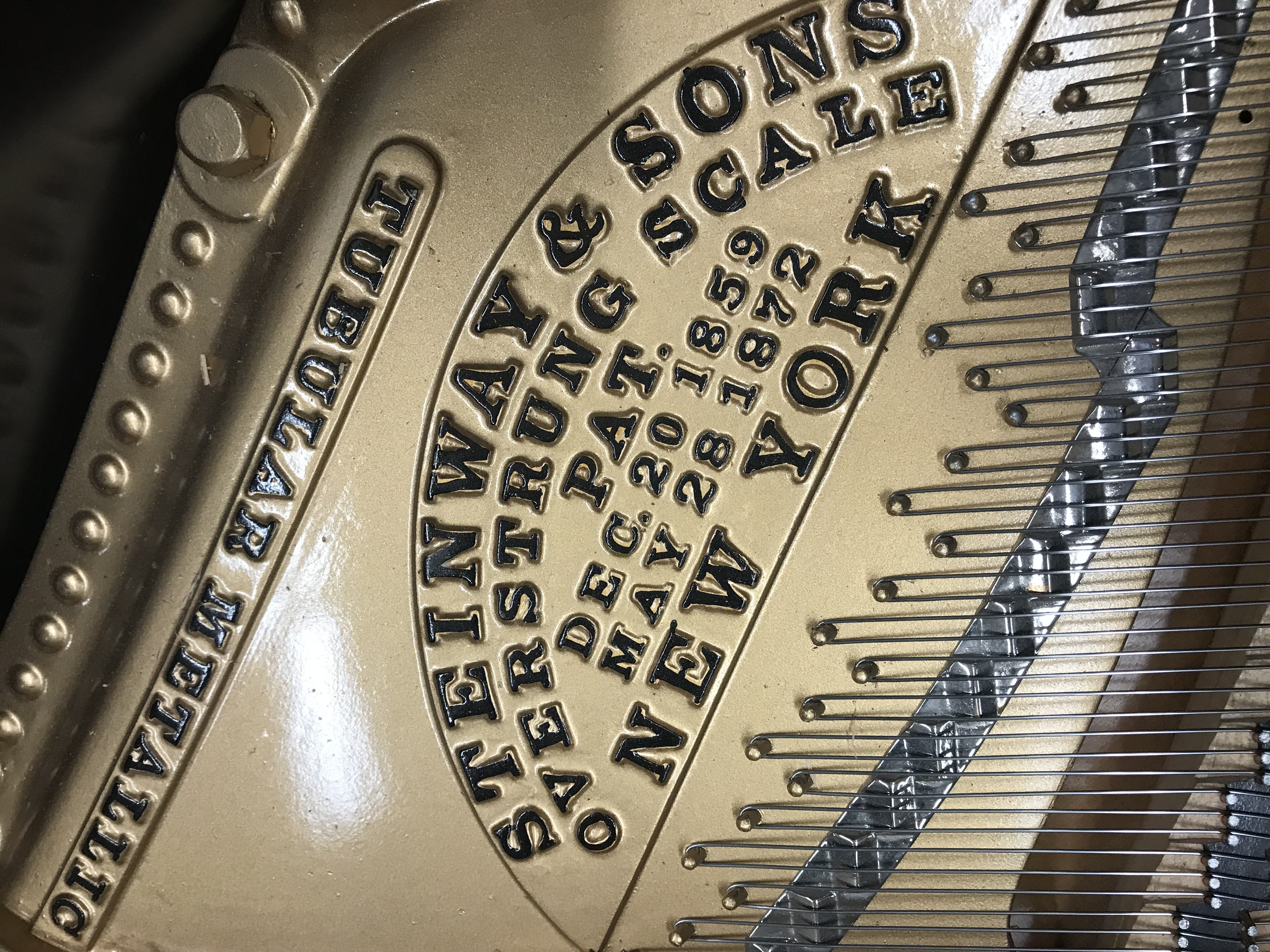

Pictured above: Operational inefficiencies in order to preserve brand craftmanship. Steinway & Sons grand piano in Cambridge, MA music store awaiting transport to New York for repair.

Why is valuation important?

Valuation is important because investors need to figure out how much to invest, and "what's in it" for them.

There are rules of thumb companies follow for how much equity to give to the first round of financing. The first round of "risk finance" -SEIS / EIS- typically ranges from 10% to 30%. Note that a single SEIS / EIS investor cannot own more than 30% of the company.

In order to decide the exact amount, the questions to be answered are: what will this do for the company? Will there be any subsequent rounds needed, and if so, how much more equity will need to be given away? Subsequent rounds of finance imply dilution for initial investors. Remember that SEIS / EIS shares cannot be protected - no preferential rights can be attached.

A pressing concern is the amount of equity the founders are to hold on exit. EIS companies can only exit after the three-year qualifying period and either via a trade sale, a buyout, or a listing on an HMRC EIS-approved exchange.

How much equity to offer external investors becomes a critical question. Founder equity shareholdings at exit appear to vary widely from less than 5% to over 90% showing that there isn't a set rule on this. Concluding that holding 5% founders' equity is inadequate, or that a 90% holding is overly generous is inaccurate, as exit valuations vary; after all, 100% of nothing is still nothing, and 5% of a £200 million exit is a considerable amount (£10 million).

Why are startup valuations unreasonably high?

Here are some reasons why startup valuations are unreasonably high:

1) Not knowing how to value a start-up. Accountants may not have adequate experience with early-stage investment valuation and may discourage entrepreneurs from raising capital early on in the company's life.

2) Overly optimistic outlook. The opportunity cost of starting a new business is high. The high level of effort, time and money committed to ventures with a high probability of failure influences entrepreneurs to dream big.

3) Benchmarking public companies without applying an accurate private company adjustment. Public information relates to larger entities, and their economics are very different from startups. Private company adjustments can be arbitrary and can feel baseless.

4) Wrong assumptions made by entrepreneurs on what investors seek. Ultimately an investor will decide the value based on several factors, some of which will be unique to that specific investor's portfolio, and others based on the company's progress in light of their business plan.

5) The wrong discount rate is being used. This is so easily done as we don't have enough time to accurately forecast inflation or the cost of capital trends.

How to value a start-up?

There are a number of ways to value a start-up:

1)Discounted cash flow analysis is a popular choice. Cash flow is typically represented by EBITDA - Earnings before Interest, Taxes Depreciation, and Amortisation - it's often used as a quick estimate but isn't the most accurate.

2) Free cash flow to the firm is ideal because it also considers capital expenditures and working capital investment, both of which impact a company's cash position.

3) Cash flow is adjusted through a discount rate to derive at the present value of cash today. The discount rate reflects not only the cost of capital but also risk.

4) Price multiples from public market data for similar small-cap companies may sometimes be used to value an early-stage startup. There are challenges with this valuation approach as it can be difficult to identify similar companies.

There are other approaches to valuing a startup, such as replacement cost. In addition to projecting cash flow, valuation also needs to reflect other issues like control or country risk.

Why start-up valuations should not be high

There are many reasons why early-stage investments should be kept at lower valuations, the main ones being:

1) Low predictability of cash flows in light of the unrealistic financial projections.

2) Weak asset base - the balance sheet shows there isn't much there.

3)The management team may be newly formed, and may not have a track record or experience working together.

4) The exit timeline and amount are difficult to estimate. An exit value drives the valuation, and its uncertainty affects achievability.

5)Start-ups typically have high cash burn rates. Remember that both the product and the team are most likely newly formed.

6) Increasing working capital requirements. As the company develops there will be higher levels of working capital required to pay salaries, bills, and other such operating expenses.

7) Investors don't have a lot of information to conduct the due diligence necessary to assess the risks and potential rewards of investing. However, startups don't have historical data to review, which reduces the amount of information available to the investor to make a decision.

8)Startups are typically not active in capital markets and can't raise debt financing easily.

Valuing a startup can be challenging because there may not be sufficient historical data and there are so many assumptions to be made. Appointing a valuation specialist is ideal but in the real world of start-ups, most entrepreneurs are cash-constrained, so the next best alternative is to proceed with knowledge of the pitfalls and apply relevant frameworks. I may be presenting an oversimplified valuation process, but my purpose is to give an introductory overview for entrepreneurs to use as a road map for a more defendable estimate of value.