| Risk Warning: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you are unlikely to be protected if something goes wrong. Take 2 mins to learn more. |

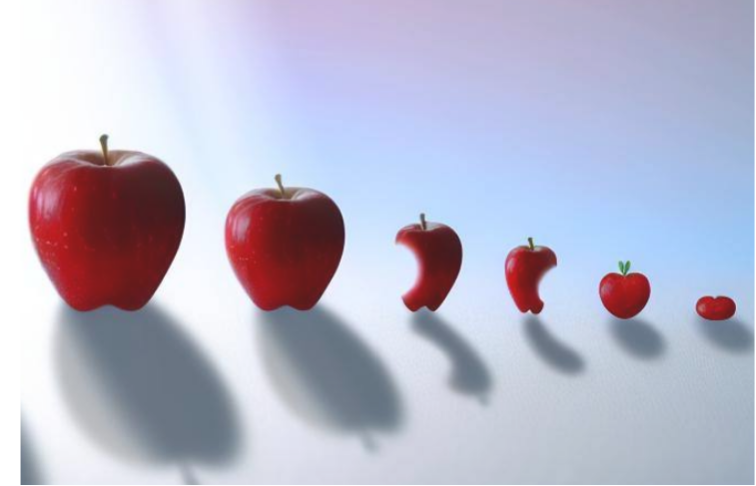

Investing in startups through the Seed Enterprise Investment Scheme (SEIS) and Enterprise Investment Scheme (EIS) can be an exciting and potentially rewarding venture. However, one aspect that investors must come to terms with is dilution. Dilution occurs when a company issues new shares to raise additional capital, which reduces the percentage of ownership held by existing shareholders. While this might sound negative, it’s not necessarily detrimental to your investment. Let’s break down how dilution works and its impact on SEIS and EIS investments through a practical example.

Initial Investment: Seed Round

Imagine you commit £10,000 to a startup during its seed round, which values the company at £1 million. In this scenario, you acquire 1% ownership of the company.

- Investment: £10,000

- Seed Round Valuation: £1 million

- Ownership: 1%

Series A Funding Round

As the startup grows, it raises £500,000 in a Series A funding round at a post-money valuation of £5 million, with a pre-money valuation of £4.5 million. Issuing new shares for this round reduces your ownership percentage since the total number of shares increases. However, the value of the company also rises, which can benefit your investment.

- Pre-money Valuation: £4.5 million

- Post-money Valuation: £5 million (£4.5 million + £500,000 raised)

- Percentage of Company Raised in Series A: 10% (£500,000 / £5 million = 10%)

Your original 1% ownership now dilutes because of the new shares issued. The new ownership percentage is calculated by multiplying the original percentage by the ratio of the pre-money valuation to the post-money valuation:

- Diluted Ownership: 1% * (£4.5 million / £5 million) = 0.9%

- Value of Your Shares: 0.9% of £5 million = £45,000

Series B Funding Round

Later, the startup raises another £2 million in a Series B round at a post-money valuation of £10 million, with a pre-money valuation of £8 million. Again, issuing new shares dilutes your ownership percentage, but the company’s value increases further.

- Pre-money Valuation: £8 million

- Post-money Valuation: £10 million

- Percentage of Company Raised in Series B: 20% (£2 million / £10 million = 20%)

Your ownership percentage dilutes further:

- Diluted Ownership: 0.9% * (£8 million / £10 million) = 0.72%

- Value of Your Shares: 0.72% of £10 million = £72,000

Exit Scenario: Acquisition

Finally, the company is acquired for £15 million. Since no new shares are issued during the acquisition, your ownership percentage remains at 0.72%.

- Acquisition Price: £15 million

- Final Ownership: 0.72%

- Value of Your Shares: 0.72% of £15 million = £108,000

Please note that most startups fail, and SEIS/EIS investments carry a high risk of total loss. The returns illustrated above are hypothetical and simplified for explanatory purposes. Real-world outcomes may vary significantly, and past performance is not a reliable indicator of future results.

Conclusion

Dilution is a natural part of the investment lifecycle in startups, especially for SEIS and EIS investors. While it reduces your ownership percentage, the increasing value of the company can lead to substantial gains. As demonstrated, despite the dilution from 1% to 0.72%, the value of your investment grew from £10,000 to £108,000. The key takeaway is that as long as the company continues to grow and increase in value, the impact of dilution on your investment can be positive.

However, it's crucial to remember that SEIS and EIS investments are high-risk. If the business you invest in fails, you are likely to lose 100% of the money you invested. Most start-up businesses fail, so it's essential to consider this risk when making investment decisions.

Sapphire Capital Partners LLP is authorised and regulated by the Financial Conduct Authority (FRN: 565716). This article is a financial promotion and is intended for UK investors only. The content is for information purposes only and does not constitute investment advice or a recommendation to invest. SEIS and EIS tax reliefs depend on individual circumstances and may change. The value of investments may go down as well as up, and investors may not get back the full amount invested. Past performance is not a reliable indicator of future performance. Investment outcomes can differ substantially, potentially resulting in the loss of all your capital invested. Shares in early-stage companies are illiquid: you may be unable to sell your holding for several years, if at all. Investors should not rely on this article as a basis for investment decisions and must consider the illiquid and high-risk nature of early-stage investing. No warranty as to future outcome is implied nor should one be inferred. Tax treatment depends on individual circumstances and may be subject to change. Investments of this type are generally not covered by the Financial Services Compensation Scheme or the Financial Ombudsman Service if the underlying companies fail.