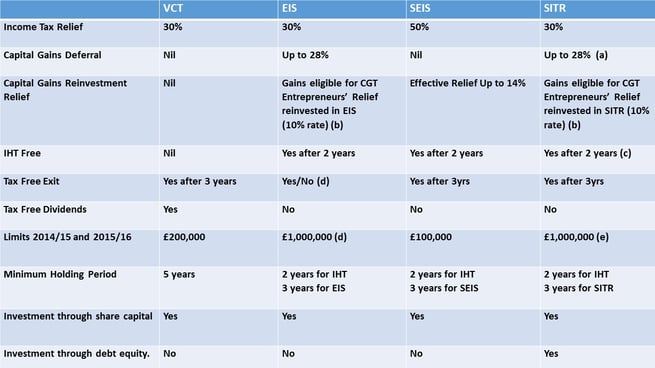

So you have money to invest, and you are wondering which tax efficient investment scheme is the best one for you. There is no doubt that the internet is awash with useful information on these schemes, but sometimes it is hard to see the wood for the trees. With this in mind the table and attached notes (a-e) below will provide a useful comparison of the key tax and other information

As you can see all of these schemes offer very attractive tax benefits. If you have a large amount to invest then you may want to opt for EIS or SITR, both of which allow for larger investments and therefore a greater amount of tax to be offset against your investment.

EIS and SITR also allow the capital gains to be held over, whilst VCT and SEIS do not, which may give you greater flexibility in managing your tax affairs.

You should note that these schemes are not mutually exclusive, which means that you can opt to invest in all four schemes in any particular tax year, and receive the accumulated tax relief.

(a) If you have chargeable gains in 2014-15, or a later year, you can defer your CGT liability if you invest your gains in a social enterprise (equity and/or debt) qualifying for SITR. The reinvestment must occur no more than three years after the disposal or one year before. On disposal of the social investment, the deferred CGT becomes payable.

(b) Gains eligible for entrepreneur’s relief which are deferred and invested into companies qualifying for EIS and SITR, will retain the lower capital gains tax rate (10%) when the gain is realised. This mirrors the broader CGT deferral relief for investments into EIS and SITR. This change took effect for disposals of assets eligible for ER on or after 3rd Dec 2014.

(c) 100% Business Property Relief (BPR) for inheritance tax may be available on shares. BPR is not available on loans.

(d) In order for you to be able to claim, and keep, EIS tax reliefs relating to your investment, the organisation has a number of rules to meet and must satisfy HMRC that it meets these requirements, and is therefore a qualifying company. The_Entrepreneurs_Guide_to_Enterprise_Investment_Schemes

(e) Up to £1m of SITR investment may be carried back to the previous tax year if the limit for that year was not fully utilised, although there is no relief available prior to the 2014/15 tax year.

I hope that this has proved useful in helping you to assess the various investment schemes. If you need more information or would like our assistance with any of these schemes please contact us, we are happy to help.