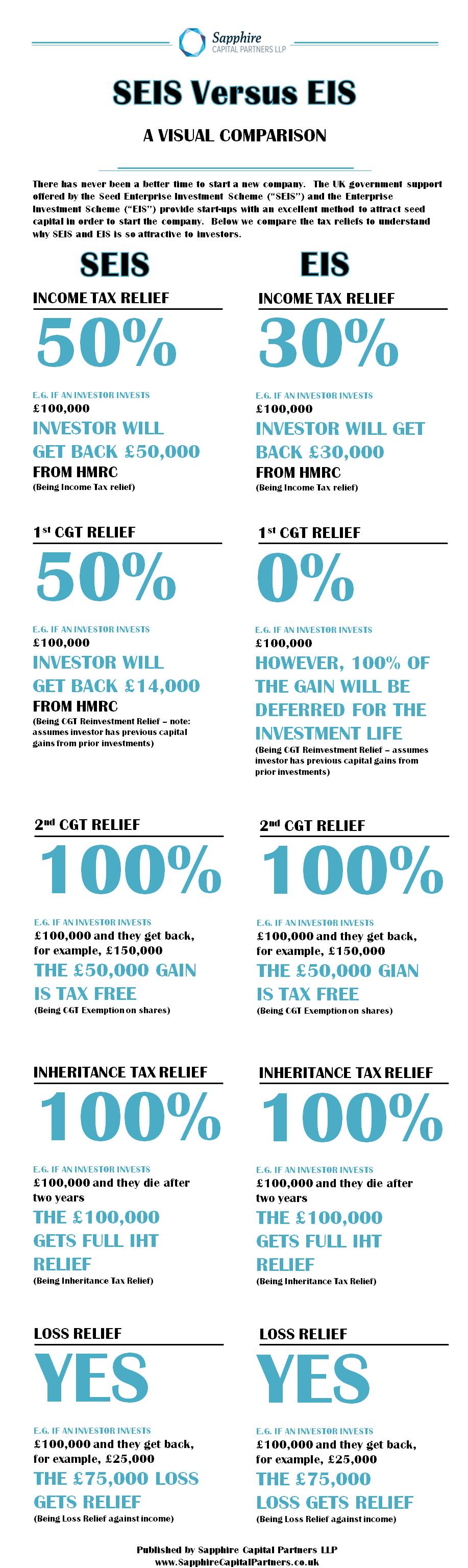

There has never been a better time to start a new company in the UK. The UK government support offered by both the Seed Enterprise Investment Schemes (“SEIS”) and the Enterprise Investment Scheme (“EIS”) provide start-ups with an excellent method to attract much needed seed capital in order to start the company. In particular the SEIS offers a start-up company the ability to raise up to £150,000 from investors in a very tax efficient manner. The SEIS is one of the most promising ways a company can raise seed capital we have seen for a long time.

Why is SEIS and EIS so important?

According to our research there are two key findings:

1) Start-up companies find it hard to raise money – the SEIS and EIS helps start-up companies attract early stage equity investment

2) SEIS and EIS offer investors very attractive tax reliefs, including income tax relief, capital gains tax reliefs and inheritance tax relief. There is also an additional relief should the investor lose money in the SEIS or EIS investment.

To give you a snapshot of all of the differences between the SEIS and EIS tax reliefs that are so important to investors, we have summarised the main ones in the infographic below.

Share This Image On Your Site

Want to learn what all of these different tax rates mean for the entrepreneur? Make sure to check out our SEIS guide, The Entrepreneurs Guide to the Seed Enterprise Investment Scheme.