For businesses hoping to grow and expand, the options to raise capital are limited. To many, Enterprise Investment Schemes and Seed Enterprise Investment Schemes can be a very effective way to solve the capital raising problem. Likewise, investors with large tax liabilities view EIS and SEIS very favourably.

At the minute though, most investors hear about EIS/SEIS schemes from their accountant, wealth manager/ IFA or the scheme promoter themselves.

A nicely printed brochure or more usually a scruffy print out is handed across along with a pitch - with the proviso, "well, if the company doesnt work out at least you'll get the tax benefit". The brochure is usually a difficult read as the FSA make certain demands- that are important to protect the investor - but they do little to illustrate the merits and finer points of the investment. Subsequently to raise all funds required can be a long and difficult process.

My view is that the success and of these schemes could be improved dramatically if promoters utilised some online tools.

People generally invest in people they believe in.

If an entrepreneur has a track record and particularly a track record you have witnessed then you are more likely to back them. The people behind many EIS scheme will have spent 20 to 30 years in business and will have gone about it effectively and quietly. Putting achievements down to hard graft and bit of luck while putting failures behind them with learning points recognised and remembered. Many are unlikely to have recorded their experience in blogs or Linkedin profiles.

There is a likelihood however that they will have admirers at different times who have watched and will want to share in their future success. This is when the effective use of Twitter and Linkedin can be very effective. An old school rolodex or little black book is invaluable but working through it can take a while. Online networking tools can be controlled unlike a lot of press or pr - and by presenting themselves effectively they will build an extended network beyond that which is in their desks.

When they have an EIS to launch, information can be widely presented and distributed quickly (keeping within the FSMA distribution rules of course!).

Another key motivator in an investors decision making process, is industry knowledge. This can explain the explosion of the buy-to-let market. We all have first hand experience of buying or renting a home, so investing in this sector has a natural feel to it. Likewise if you spent your career in an industry sector you will know if a new product or service for that industry has a realistic chance of success.

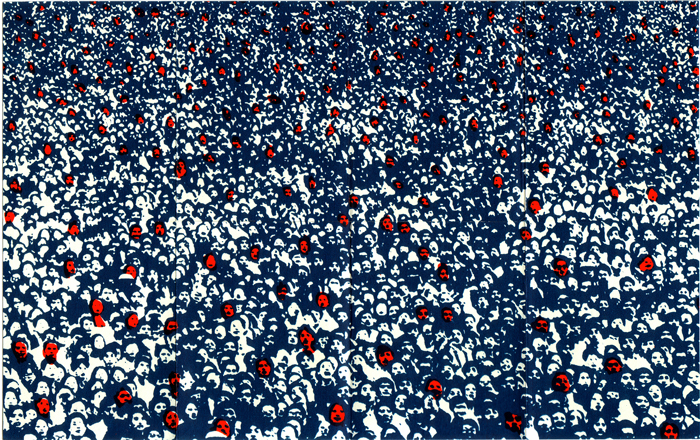

This is where crowd funding has a role to play in presenting investment opportunities. By browsing by sector on crowdfunding platforms you are more likely to find businesses that you understand and can make an informed decision about.

A good crowd funding site will have a full company disclosure, offering document for the EIS and a video clip from the company. This will include a pitch but the more innovative will show product or service in action and as much back ground as possible. It will also give a lot of background on the individuals behind the scheme. As outlined above Linkedin and Twitter can also support this aspect of providing information (adhering to FSMA rules of course).

Unlike a dull FSA brochure this combination of detailed fact and a personal appeal to join the business as a shareholder makes the investment process more personal and more than just a way to reduce your tax bill.

The holy grail will be when that opportunity is in a sector you love has been developed by someone you believe in.