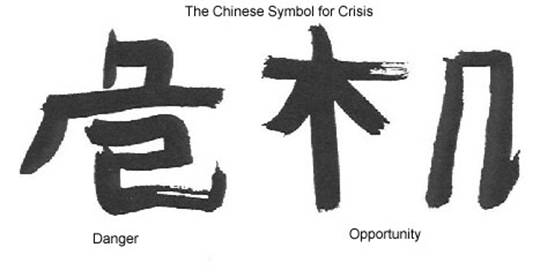

The Chinese symbol for crisis is danger and opportunity. The crowdfunding sector viewed the 2008 banking crisis in this way. An opportunity opened for those with capital to fill the credit void left by banks and government to assist businesses (start-ups, smes or larger organisations) with loans or equity investments to help them grow or expand.

There was of course danger; can these crowdfunders with a presence solely on the world wild web, effectively represent entrepreneurs looking for funding and those wanting to invest?

It looks like they can:

There are a total of circa 536 crowdfunding platforms operating world wide.

These platforms raised circa $1.5bn in 2011 with $2.8bn estimated for 2012

Funds raised grew at 63% CAGR over the last three years. Reward based platforms are growing at the fastest rate but from a smaller base.

Crowd Funding is of course a very generic term with different providers offerings something different to investors and businesses.

There are crowd lenders such as Funding Circle who invite businesses to approach the crowd for loans. They present a business case for the loan - manufacturer needs a new piece of equipment/technology firm need cash injection for R&D/restaurant wants a new pizza oven etc. They also publish credit report/accounts and lending terms. Individuals can then decide to lend. They also have an opportunity to sell on their loan to other members of the site. These pledge sites have the benefit of giving investors short term return and the opportunity to get a relatively secure, fixed income - if the loan performs as it should.

There is also a fast growing sector known as equity crowdfunding, such as Seedrs.com or ASSOB.com.au (Australian Small Scale Offerings Board), which offer arm chair investors the chance to be Dragons. Equity based crowdfunding is the smallest sector but is the fastest growing category by net year on year growth.

Once registered on their sites, investors can make relatively small investments in start ups or small businesses they think have a bright future. Investors generally will have prior knowledge of the management team or the industry. On the ASSOB website each company launch usually attracts 60% of investment from "friend and family" investors. One can assume the other 40% comes from industry experts, enthusiasts or those whose imagination has been captured. This is often seen as a hope investment, but the returns are seen as being potentially much greater. The businesses also often offer the opportunity for investors to provide professional support or advice to the business. This provides both an obvious opportunity for business but the danger of unhelpful interference is also prevalent. In these cases the host platform can be intermediary.

As new entrants take advantage of the opportunities presented by a significantly less dominant banking sector the sheriffs of the financial sectors of the internet, the FSA and SEC, have seen the potential dangers and are starting to act accordingly. The US government is expected this year to enact the JOB's act which will allow all investors to invest on crowdfunding sites but with certain restrictions. In the UK the FSA are still looking at this field, so investors are advised to take advice and as always read the small print.

Its clear that crowdfunding is a natural progression and broadening of the traditional activities of angel investors and armchair traders who trade on the equity and FX markets. It is also a great new opportunity for startups to both attract investment, champions of their business and also present their ideas to an international audience.

What is exciting is what other activities currently carried out by banks and financial institutions will be provided by crowd funding platforms. Only time will tell.